On May 24, the price of 40 TEU large containers from Tianjin to Meidong in May was 13000 US dollars. Before the epidemic, the price of containers of the same specification on the same route was less than 3000 US dollars.

Unexpectedly, in June, the freight rate is more crazy.

In the first half of June, the cost of a 40teu container from Tianjin to Meidong was US $14000-16000, while it rose to US $17000-18000 in the second half of June.

On the one hand, the price has skyrocketed; on the other hand, the shipping company is short of shipping space.

Due to the surge of market demand, shipping companies are also picking customers and providing shipping space according to VIP level.

Mr. Zhou, who was interviewed by the 21st century economic report, said that several foreign-funded shipping companies had told him that they could not help him. Even for their long-term cooperation companies, the allocation of shipping space was taken to the group level, and the Chinese branches could no longer choose customers.

According to the staff of the shipping department, the group issues the list of priority customers to the shipping company, which has multiple levels from vvvip to VIP.

Usually at the top of the list are the enterprises of the countries where the shipping companies are located and large multinational companies, such as the Chinese enterprises where Mr. Zhou is located, which are relatively low in ranking and can hardly be allocated to the shipping space.

"This kind of guest picking is prevalent in foreign-funded shipping companies. Japanese shipowners will give priority to Japanese enterprises and other large multinational companies with limited shipping space. Even if they have cooperated for many years, it is difficult to obtain one and a half cabins."

Herbert, Dafei, Wanhai and other shipping companies have announced to increase all kinds of surcharges. The freight is higher than the value of the goods. How can small and medium-sized enterprises resist the freight vortex?

Let's talk about today's second topic: one announced 52 voyages suspension of Yantian / Shekou port!

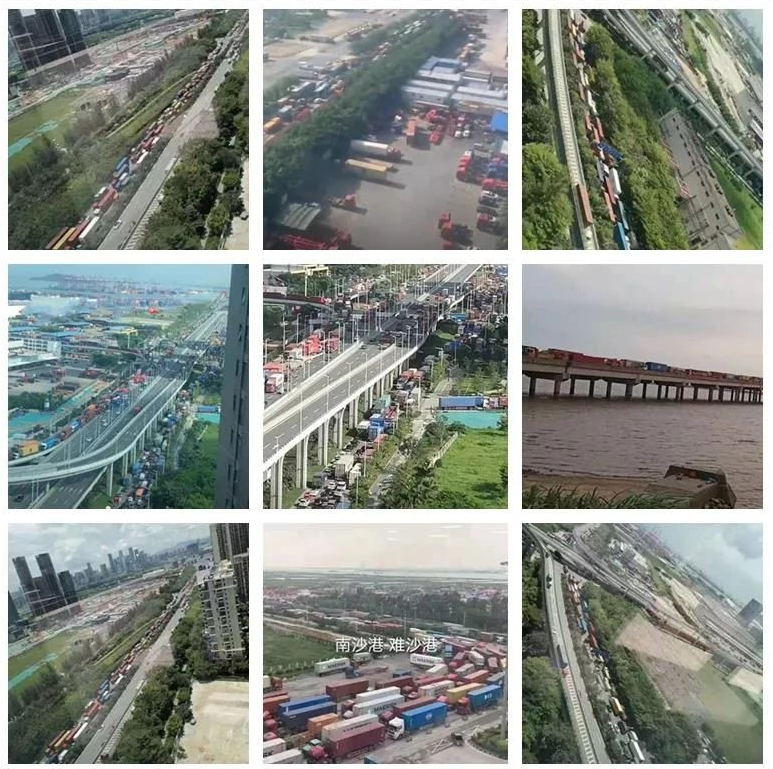

From the 17th week to the 22nd week, the import volume of Yantian Port decreased by 19%. In the same period, the import volume of Nansha Port decreased by 16.4%, while that of Shekou port decreased by 29.6%.

The import volume of each port also decreased significantly on a week to month basis.

In the 22nd week, compared with the 21th week, Yantian Port decreased by 4.1%, Shekou (- 16.7%) and Nansha (- 10%).

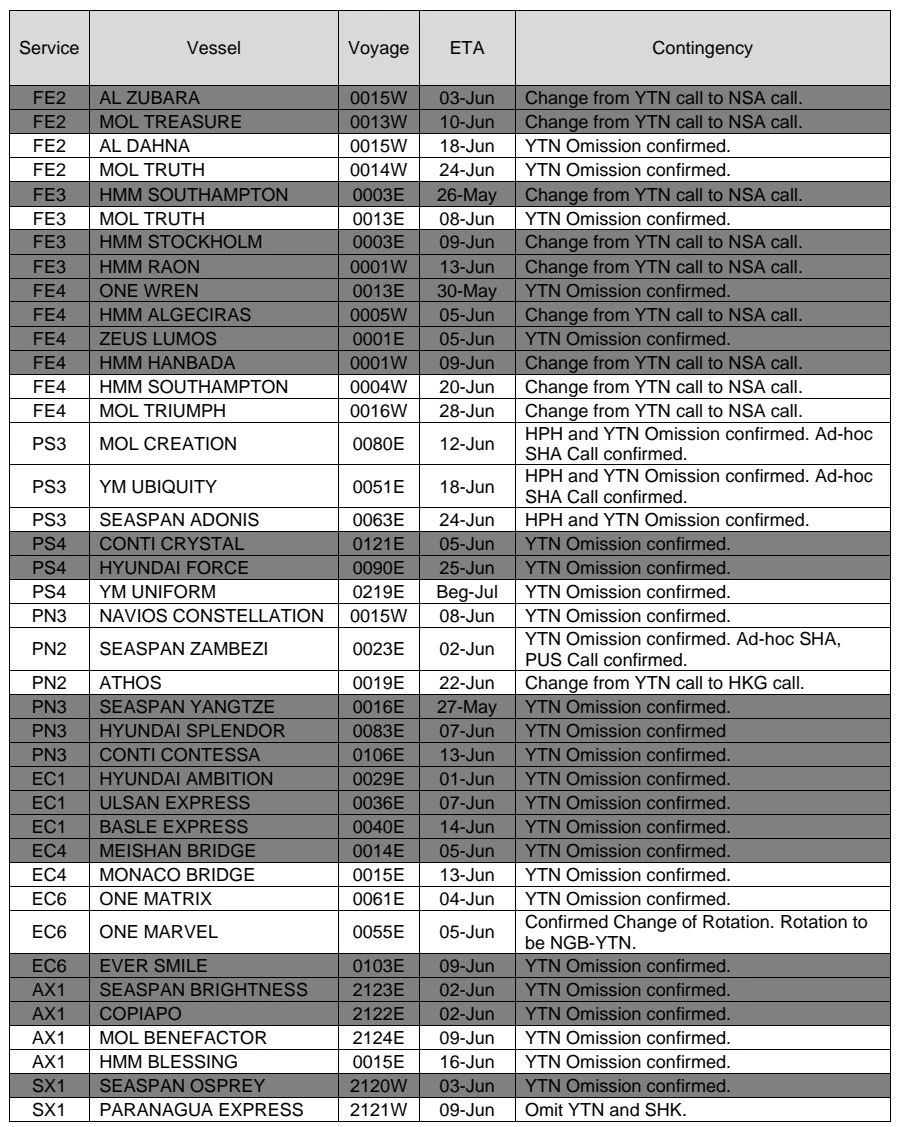

One also announced that, following the announcement on June 5 that some flights will be suspended from connecting to ports in South China, 25 new flights will be added, with a total of 52 flights suspended from connecting to ports in South China, and an alternative plan will be announced.

The specific adjustment is as follows (Note: the white area is the new voyage)

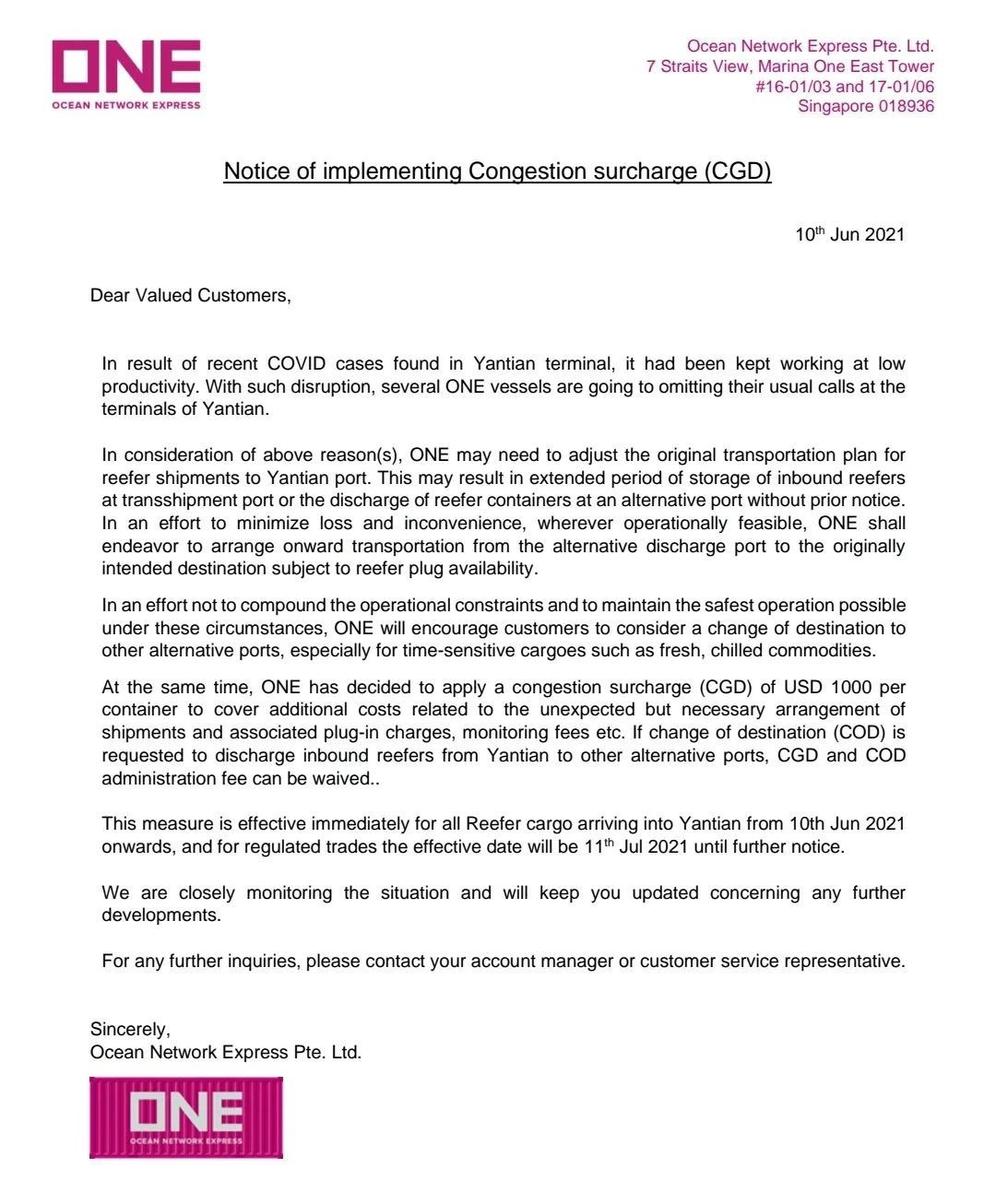

Due to the recent epidemic, Yantian Port has been in a state of low productivity. In view of this, many one ships will no longer dock at Yantian wharf.

In view of the above reasons, one needs to adjust the original transport plan of refrigerated containers to Yantian port. This may result in extended storage time of inbound reefer containers at the transshipment port or unloading at alternative ports without prior notice.

In order to minimize the loss and inconvenience, one tries to arrange the subsequent transportation from the alternative unloading port to the original intended destination according to the availability of the refrigerated plug when the operation is feasible.

In order not to complicate operational restrictions and to maintain as safe operation as possible in this case, one will encourage customers to consider changing the port of destination to other alternative ports, especially for time sensitive goods such as fresh and refrigerated goods.

At the same time, one decided to charge a congestion surcharge of US $1000 per container to cover the additional costs arising from the unexpected but necessary transportation arrangements and related plug costs, monitoring costs, etc.

If it is required to change the port of destination (COD) and unload the inbound refrigerators from Yantian to other alternative ports, CGD and COD management fees can be exempted.

This measure will take effect immediately from June 10, 2021 for all refrigerated cargo arriving at Yantian port. For controlled trade, the effective date is July 11, 2021, with further notice.