Extreme integration of the container liner industry is a dream for tanker and bulk carrier owners.

Alphaliner's latest data highlights the extent of liner consolidation, the timing of ranking changes, and how new shipbuilding orders will make the carrier sector more focused than it is now.

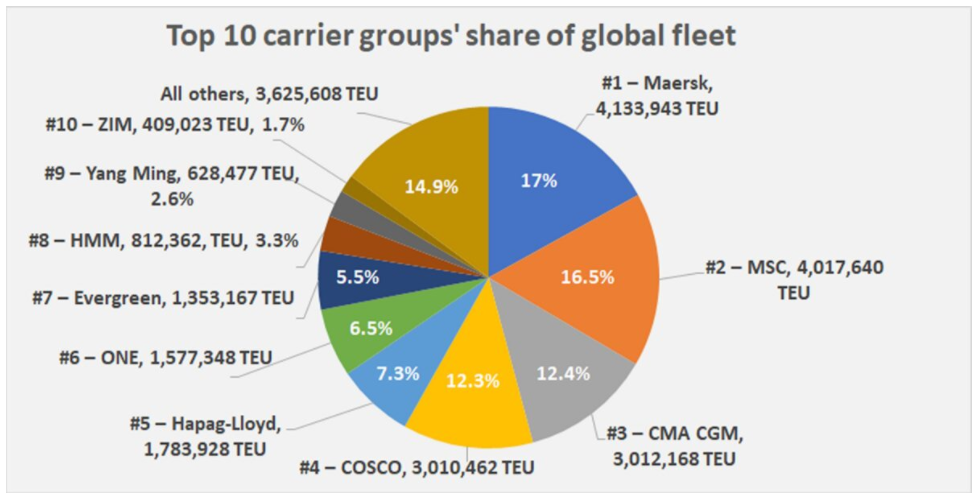

At present, the world's top 10 shipping companies operate 85% of the capacity.

Among them, Maersk, MSC, Dafei and COSCO Shipping control more than half of the transport capacity (58%), while seven shipping companies including Herbert, one and EVA shipping control 78%.

At this basic level, the concentration of the fleet has been greatly improved, because on the main routes between the East and the west, there are three ship sharing alliances - 2m, ocean alliance and the Alliance - whose members account for nine of the top 10 liner companies.

MSc's big move

In the liner ranking, MSc is at the top.

The Swiss based shipping company is very active in the second-hand market, the charter market and the new shipbuilding market, with 49 ships purchased since August last year.

Including the recent acquisition of three second-hand ships, MSC has just surpassed the milestone of 4 million TEUs fleet. Alphaliner points out that MSC's fleet has increased by 4% since the beginning of this year alone.

Including new ship orders, MSC actually surpassed Maersk a few months ago and became the largest shipping company in the world. Even in terms of ships operating on water, MSC will soon win the championship.

Alphaliner said: "number one may even happen before the end of this year, as MSC will take over four more 23656teu super large new ships in the next few months."

New shipbuilding promotes more transport capacity

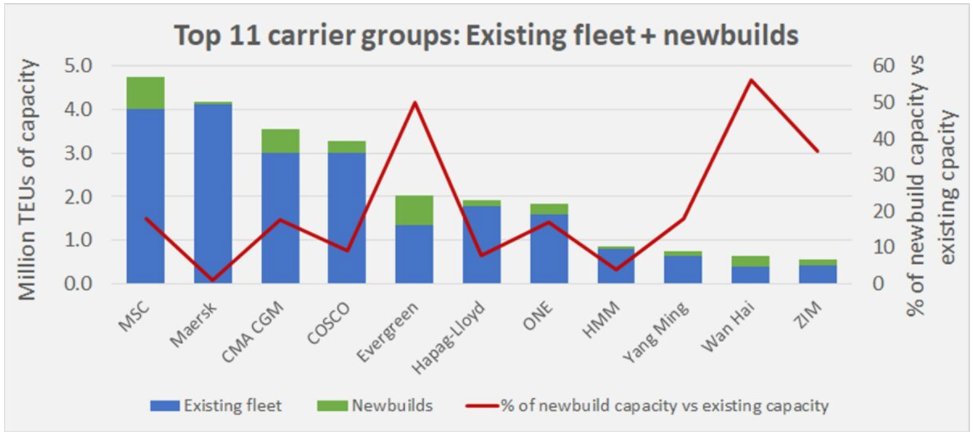

MSc will be far ahead when all the new ships ordered are delivered.

Although the total number of vessels operating on water and new shipbuilding is not equal to the future capacity (because there can be more orders during this period, and vessels can be rented, sold or scrapped), it does provide an indicator of future ranking.

Among all the large liner companies, Maersk has the least orders, and its new capacity is only 0.9% of the water capacity.

In sharp contrast to alphaliner's data, MSC's orders account for 18% of its operating fleet.

The total capacity of MSC's existing ships and new ships is 4742400 TEU, which is 14% and 34% higher than that of Maersk and Dafei respectively.

In addition to the "who owns the largest fleet" contest between Maersk and MSC, more widely and more importantly, the world's top shipping companies will become the main recipients of new shipbuilding in 2023-24, which will be ordered from the fourth quarter of 2020.

Among the other top players, Wanhai's orders accounted for 56% of the fleet, Evergreen's 50%, Yixing's 37%, Dafei and Yangming's 18%, one's 17% and COSCO's 9%.

Over time, new ships ordered by non operating owners are regarded as charterers, and these percentages will further increase.

Part of this new capacity is the replacement of old ships, but new shipbuilding data show that the capacity control of the top 10 liner companies will rise from the current 85% level to 90%.